bicity

ECONOMIC FORCES

The economic forces are the external factors that have a direct impact on the potential attractiveness of various strategies into industries. to drag and drop me anywhere you like on your page. I’m a great place for you to tell a story and let your users know a little more about you.

1. Propensity of People to Spend

It refers to the percentage of income that is spent on goods and services rather than on savings

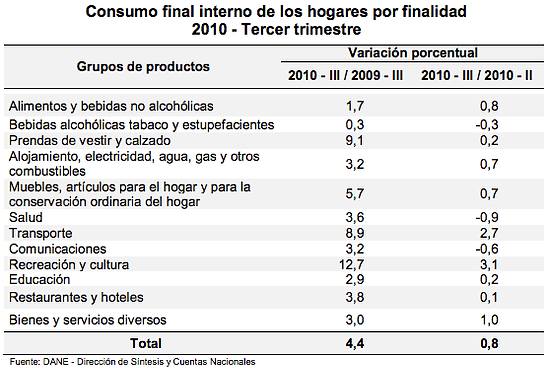

This chart shows both the propensity of Colombian people to spend as the consumption growth by areas. We can see in the graph, the propensity of the Colombian homes to spend in health and the continuous increasing home consume at transport and recreation. It gives the sector confidence to invest in it.

(Ihttp://www.dane.gov.co/files/investigaciones/boletines/pib/bol_PIB_IVtrime13.pdf)

2. Gross Domestic Product Trend

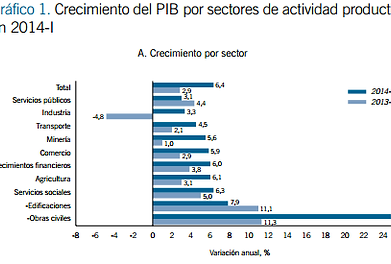

The Gross domestic product (GDP) is the best way to measure a country’s economy, in other words is the worth of the economy and for that reason it is supposed that if the GDP grow so do the country's wellbeing . According to the experts, Colombia will grow between 3,5% to 4,5%, this rate is higher than the average of the region. Sectors like transport and social services are growing in an important rate. Transport sector growth 4,5% in 2014 while social services growth 6,3%. It’s expected that those sectors will grow as similar as 2014 so it’s a great opportunity to invest in it.

(http://www.dane.gov.co/files/investigaciones/boletines/pib/bol_PIB_IVtrime13.pdf)

3. Stock Market Trend

Stock market trend is a tendency of financial markets to move in a particular direction growth or decline. It is based in the trust and in the performance of the market. In the year 2014 Moody’s and Standard & Poor's y Fitch changed the Colombia risk rating giving it a better qualification, that mean more trust from the investors and making Colombia's stock market more attractive to invest

4. Income Differences By Region and Consumes Groups

Income differences by region and consumes groups are represented in the chart, which shows a distribution of the population by regions and shows its relatives incomes.

Most of the population is located in Bogota with 17,5% also it is allocated the most and higher per capita incomes, that mean that Bogotá people have more money to spend and it is more opportunities to sell a product.

(http://www.banrep.gov.co/docum/Lectura_finanzas/pdf/DTSER-108.pdf)

5. Coalitions of Lesser Develop LDC

Colombia is considered as an underdeveloped country. The Organization for economic co-operation and development OECD, is a coalition that looks join forces to strength the economy of his participants and to promote other countries to grow

The OECD had high lined the great development of the Colombia’s economy by its good monetary policies. Colombia is gaining merit to enter to the OECD and if that occur Colombia will be more trustable to investors

6. Level of disposable income

It refers to how much money families have to spend and save after paying income taxes.

The level of disposable income in Colombian families has been showing a trend that increases since the year 2000. Some researches have find out that nowadays the increase of the disposable income is 3 times higher than it was many years ago, reaching an increase of almost 10% per year.

This increase of the disposable income is a benefit for services companies as people have more money to spend in things that are not considered basic needs.

http://anif.co/sites/default/files/uploads/Ene23-14.pdf

7. Federal Government Budget Deficits

It is the difference between the incomes that the government gains (taxes) and the debts they have to pay.

According to the Financial Plan of Colombia the federal deficit have decreased 0,1% since the year 2013 and in 2014 it reached to 1,3% of the GDP.

As government is a stakeholder that affects almost all the organizations, if there is a high federal deficit many companies will be disturbed, but if the federal deficit is decreasing public organizations will generate more jobs and it will probably cause an increase in the minimum wage

http://www.minhacienda.gov.co/HomeMinhacienda/politicafiscal/CierreFiscal/2014

http://www.reuters.com/article/2014/12/04/colombia-economy-fiscal-idUSL2N0TN2P020141204

http://www.dinero.com/economia/articulo/plan-financiero-2014/191766

8. Worker Productivity Levels

It refers to the amount of output produced per work hour by each individual.

In Colombia the levels of worker productivity are really low nowadays, which leads into a threat for this industry as the productivity of the companies will also decreased, generating a low income and lower earnings.

A recent study reveals that in Colombia there are required 4,5 people to complete the job of 1 people in the United Stated this lead us to understand that companies in this industry will need to hire more employees in order to accomplish the goals in the period of time proposed, causing more expenses in salaries that could be used as an inversion in other areas that the organization must have to achieve improvement.

http://www.eltiempo.com/economia/sectores/baja-productividad-en-colombia-/14603116

http://www.dane.gov.co/index.php/industria/indicadores-laborales-de-industria

9. Value of The Dollar In World Markets

The value of the dollar in Colombia has had an incredible increasing in the last months; it has passed from 2000 Colombian pesos to 2300 Colombian pesos in just few months. This rise affect positively to the exportations and the coffee producers, but it is affecting negatively to the petroleum companies, the people who want to travel to countries such as United States, and the imports as people will have to pay more for the same price in dollars.

We can consider that it will affect this industry if we are looking for raw materials that are being imported from different dollar economies places.

http://www.semana.com/economia/articulo/el-precio-del-dolar-se-enloquecio-en-colombia/410962-3

http://www.eldiario.com.co/seccion/ECONÓMICA/d-lar-se-hace-fuerte-al-cierre-del-20141411.html

10. Monetary Policies

Colombia’s monetary policy is based in maintaining a low and stable inflation rate with a maximum sustainable growth of the economy and the develop of more employs looking for the welfare of the entire population.

The industry can take advantage of this as in industry services we need more people to do the jobs and this will generate more employees following the monetary policy.

http://www.banrep.gov.co/es/politica-monetaria

11. Inflation Rates

According to the annual report of inflation provided by the bank of the republic (02/02/2015), after a fall in prices since October of 2011 until December of 2013, the Colombia’s inflation rate has been growing steadily to a current value of 3.82%. Consumers cannot save as much as before. They are forced to dedicate more money that before in the acquisition of goods and services, inasmuch as prices has increased. The savings capacity diminishes.

This movement represents a disadvantage as the products that come up in times of inflation are the most consumed. The most demanded will be the staple products and in this case the funds of customers will be diverted. If food or clothing prices are skyrocketing household economies suffer and won’t have enough money to expend in extra services; however, this need to save money could lead them to find ways to spend less, within which one could be using a more economical transport.

12. Unemployment Trends

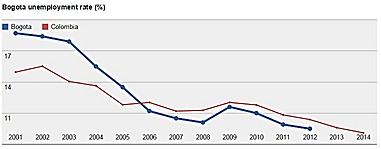

The unemployment rate in Colombia has been declining since late 2010, in a process of economic recovery from the 2008-2009 crisis.

The recent economic slowdown has been reflected in a slower rate of decline in the unemployment rate which nowadays is in 8.7%, a situation that was foreseeable as unemployment approached its long term level, consistent with the economy growing around its potential.

During 2014, the unemployment rate has continued to fall and continues to give positive signals for dynamic private consumption; however, behind the reduction in the unemployment rate, there are signs that show deterioration in the quality of employment and this implies an advantage for our industry because most people will need to be transported and will have the resources necessary to afford it.

13. Tax Rates

Taxes in Colombia apply to all the inhabitants of the national territory with the same tariff, Here is brief description of the most important taxes that were taken into account to make our analysis:

This factor is critical because it is the contribution that we as citizens and organization of the country have to pay to the government in order to contribute to the public expense. It is an obligation and responsibility; therefore we must meet it in order to avoid falling into legal problems and make a threat for the company to become and to carry out the functions within the legal framework of the government.

14. Imports and Exports

As shown in the graph, we can notice that the imports to Colombia had increased in a good way in the past 4 years, due to an enhance of trust by other countries to do business with Colombia; United States and China being the main entities in these negotiations. This means for our industry that world markets are more interested on bringing their products to our country, therefore, this can be a big opportunity because the technology needed to improve our business can be brought easier helping to innovate.

Colombia exports have increased nearly doubled in the last seven years, however, still below imports which generates a negative trade balance. This does not directly affect our industry, since any process within the provision of the service is affected by exports.

15. Price Fluctuations

The behavior of inflation is under control and is in line with the goals of the Central Bank, which on this side sees no major threats even though the economy is growing at lower rates. (EL PAIS, 2014).

What most influenced the consumer price index in 2014 were the educational costs which rose 4.16% in the country, next, health prices which increased 3.18% and housing than they did in 2.25%.

The price fluctuations are based on how much of a product is put on sale in one day, changes in short-term demand and the market availability of competitive products. Taking this into account, the products affected by this economic force are the commodities and services are not harmed by them.

16. Availability of credit

According to the republic bank it is observed that in January of 2012 there were fewer agents perceived the access was easy showing a fall of 7,4 percentage point from the figure recorded six months ago. 81.5% of the agents perceived it is easy, while 13.6% believe that credit availability is low. Finally, regarding the credit availability for the next six months, 66.7% believe they will have no change, 21% believe that this will be lower than the current and projected to be 9.9% higher. (Banco de la Republica, 2012)

However According to the latest survey of expectations conducted by the Central Bank in June 2014, 82.7 percent of local entrepreneurs considered to be high resource availability, which becomes the highest record in at least two years and also according to businessmen and academics, the Colombian economy has ample liquidity and credit availability. (Portafolio, 2014)

The availability of credit affect the services companies directly because that give consumption capacity to people and in this way the will have more money to spend in different and new services. If people don't have enough money they will not spend in services that are not mandatory or obligatory.

Taken from: http://www.portafolio.co/negocios/disponibilidad-credito-empresarios

http://www.banrep.gov.co/docum/Lectura_finanzas/pdf/rbdc_mar_2009.pdf

17.Money market rates

According to the institution “DANE” the policy of money market in Colombia is governed by a system of Inflation, the purpose is maintain a rate of inflation low and stable and also reach output growth in line with the potential capacity of the economy. That means that the objectives of this policy combine the goal of price stability with maximum sustainable growth in output and employment.

According to the republic bank the main instrument of monetary policy of the Colombian central bank to intervene in the money market (increase or decrease the amount of money in the economy) are the open market operations (OMA). When required to increase liquidity they increase the amount of money in circulation in the Colombian market, the Central Bank buys securities or financial papers. Thus the Issuer injects money into the Colombian economy. This type of operation is called OMA expansion. By contrast, when the Bank requires reduce liquidity they collect money from Colombian market, then sells securities and therefore collects money from the market. This type of operation is called OMA contraction.

According to an article published in January 5 2015 of the magazine Portafolio and the institution “DANE” reveals that inflation in 2014 shows an increase of 3.66 percent, driven mainly by rising food prices, education and housing. The variation of last year exceeded 1.72 percent recorded in 2013 (1.94 percent). (Portafolio, 2015)

Taken from: http://www.portafolio.co/economia/inflacion-colombia-2014-0

The money market rates affect the services companies in different ways, mainly when there is a high flow of money circulating in the country because this increase inflation and when this happen prices increase too. When prices rise the demand decreases especially when goods and services are elastic, this means that as the price increases the demand is lower. When prices rise, demand decreases especially when goods and services are elastic. This means that as the price increases low demand. (Banco de la Republica,2014)

Taken from: http://www.banrep.gov.co/es/politica-monetaria

18. Demand shifts for different categories of goods and services

According to the institution “DANE” the “IPC” is an indicator that evaluate and measure the variation of prices of the most representative goods and services in the country. This must be taking into a count to measure the demand shifts because according to this people buy and spend their money in goods and services.

In the table above are the variation of the “IPC” of the last three years in each city of the country. (Dane, 2014)

As we can see the group who had more variation in 2014 according to the “IPC” is transport, this group was the one with more demand shifts. (Dane, 2014)

This is one of the aspects that affect the most the services companies because if the demand increases it is necessary to increase the offer too in order to keep the balance and satisfy the market. If there are more people wanting and demanding the same goods and services, the companies that supply those needs are going to grow and expand their business and operations.

http://www.dane.gov.co/index.php/indices-de-precios-y-costos/indice-de-precios-al-consumidor-ipc

Soy un párrafo. Haz clic aquí para agregar tu propio texto y edítame. Soy un lugar ideal para que cuentes una historia y perm19. Export of labor and capital from the United States

In the table above are the number of American people that arrive to Colombia during 2009 and 2012. (Proexport Colombia, 2012)

ue tus usuarios conozcan un poco más sobre ti.

In the table above are the destiny in Colombia busier from foreign (Proexport Colombia, 2012)

In the table above are the main reasons of traveling to Colombia from foreign. (Proexport Colombia, 2012)

This factor is not really relevant to the industry and services companies of transport because the number of foreign people from North America is not really significant and the principle reason for travel to Colombia is turism.

Although the figures are from 2008 the trend has been to go to United States to work for the famous "American Dream", that’s why the number of Colombians working in the United States is much higher than Americans working in Colombia. This figure has increased since the facilities of travel and the agreement of TLC.

http://www.oim.org.co/migracion-colombiana/datos-sobre-migracion-colombiana.html

Imagen tomada de wix.com

20. Level of disposable Income

The level of disposable income has grew significantly from1992 to 2005, this represents that people have more income to expend after they had payed all the bills and necessary payments causing an increment on the money they have to afford what they really want; this can help the rental bicycle service because it is not considered a necessary service but a "luxury" service, so if people have more money to expend on what they want, the bicycle rental service would be affected positively.

21. Interest Rates

The interest rates in Colombia have changed in the past 13 years, the rate of intervention in the year 2000 was 12,0 and in 2013 was 3,25, there you can see that it has dramatically decreased what make us think that it will continue that way. The rate for consume, in 2000 was 28,77 and in 2013, 17,90 it has decreased. This information represents for the industry of the bicycle rental service, that people can afford the service without having to pay the bank much more money that what the service really costs making our demand to increment.

23. European Economic Community

Political relations of the European Union with Colombia and other countries in Latin America are part of the provisions of the Treaty of Lisbon entered into force on December 1, 2009.

Policies have been stable relations between the EU, Colombia and its neighbors. Its historical, cultural and ethnic ties have maintained a constant dialogue between these regions, which in the case of Colombia is situated at three main levels; dialogue and cooperation with Latin American countries - particularly with the Rio Group, under EU / CAN Cooperation Agreement and bilateral relations between the EU and Colombia.

The EU act in five different axis. The first one, support to the government. Second, defense of Human Rights and International Humanitarian Law. Third, combating the causes of violence and helping victims of violence. Four, Protection of biodiversity and the environment. Fifth, Strengthened coordination and regional cooperation.

The aspect that affect the most the services companies in Colombia is number four, the protection of biodiversity and the environment. Environment is part of the stakeholders in a company, that’s why anything that happen in the environment will affect the company directly or indirectly and anything that happen in the company could affect the environment. Also social responsibility nowadays is very important for companies and they work hard in order to achieve and help in the society they work.

http://eeas.europa.eu/delegations/colombia/eu_colombia/political_relations/index_es.htm

22.Propensity for People to Expend and Consumption Patterns

This graph shows both, the propensity for people to expend and the consumption patterns because with the amount what they consume, we can understand their propensity to expend. Here we can see how recreation and culture is in what people consume more with transport and clothes, what represents a great opportunity for the bicycle rental industry because we can se how people are propense to expend on, and that the consumption patterns of a typical Colombian is clothes, services (water, gas, electricity), furniture, communications, restaurants and recreation.